Did You Skip Li Auto’s (NASDAQ:LI) 86% Share Rate Obtain?

It could be of some problem to shareholders to see the Li Auto Inc. (NASDAQ:LI) share price tag down 10% in the previous month. But hunting again over the last year, the returns have truly been alternatively pleasing! In that time we have seen the stock quickly surpass the market return, with a acquire of 86%.

See our hottest evaluation for Li Car

Li Auto was not rewarding in the past twelve months, it is unlikely we’ll see a powerful correlation concerning its share cost and its earnings for every share (EPS). Arguably earnings is our next best possibility. When a firm doesn’t make earnings, we’d usually be expecting to see superior revenue advancement. That’s because it is really tricky to be assured a corporation will be sustainable if earnings growth is negligible, and it never helps make a earnings.

In the last 12 months Li Vehicle noticed its revenue develop by 972%. That is stonking development even when as opposed to other reduction-building shares. Even though the share price tag acquire of 86% above twelve months is fairly delicious, you could possibly argue it will not absolutely replicate the solid revenue progress. If which is the situation, now could possibly be the time to acquire a close glimpse at Li Car. Given that we developed from monkeys, we assume in linear phrases by character. So if expansion goes exponential, opportunity might exist for the enlightened.

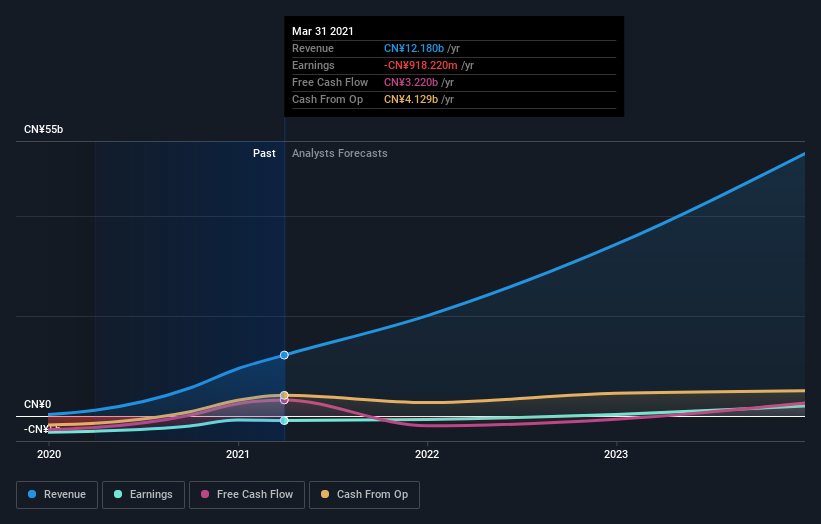

The firm’s earnings and earnings (over time) are depicted in the graphic beneath (click to see the correct numbers).

Li Auto is a effectively recognised stock, with loads of analyst protection, suggesting some visibility into foreseeable future development. You can see what analysts are predicting for Li Automobile in this interactive graph of foreseeable future profit estimates.

A Distinct Viewpoint

Li Vehicle shareholders should be joyful with the overall attain of 86% above the previous twelve months. A substantial portion of that attain has occur in the past a few months, with the stock up 55% in that time. This suggests the business is continuing to gain more than new buyers. I uncover it very attention-grabbing to glimpse at share price in excess of the extended expression as a proxy for business functionality. But to truly achieve perception, we need to contemplate other information and facts, as well. Consider risks, for instance. Every single business has them, and we have spotted 1 warning indication for Li Auto you need to know about.

Of course, you may well uncover a fantastic financial commitment by looking elsewhere. So consider a peek at this free of charge record of organizations we count on will improve earnings.

Please take note, the market place returns quoted in this posting mirror the market weighted regular returns of shares that currently trade on US exchanges.

Promoted

If you’re hunting to trade Li Automobile, open an account with the lowest-price tag* system trusted by experts, Interactive Brokers. Their consumers from about 200 countries and territories trade shares, possibilities, futures, foreign exchange, bonds and money around the globe from a single built-in account.

This report by Simply Wall St is typical in character. It does not represent a advice to purchase or provide any inventory, and does not acquire account of your targets, or your financial predicament. We intention to provide you extended-term focused investigation driven by elementary data. Observe that our analysis may well not variable in the most current rate-delicate enterprise bulletins or qualitative material. Just Wall St has no situation in any shares outlined.

*Interactive Brokers Rated Most affordable Price tag Broker by StockBrokers.com Once-a-year On line Assessment 2020

Have feed-back on this post? Concerned about the articles? Get in touch with us specifically. Alternatively, email editorial-staff (at) simplywallst.com.