Chip scarcity highlights U.S. dependence on fragile provide chain – 60 Minutes

Vehicle organizations throughout the world have had to idle production and workers because of a shortage of semiconductors, normally referred to as microchips or just chips. They are the little running brains inside just about each fashionable product, like smartphones, healthcare facility ventilators, even fighter jets. As we to start with noted in Could, the pandemic despatched chip desire soaring unexpectedly, as we bought desktops and electronics to function, examine, and enjoy from residence. But whilst far more and much more chips are wanted in the U.S., less and fewer of them are manufactured listed here.

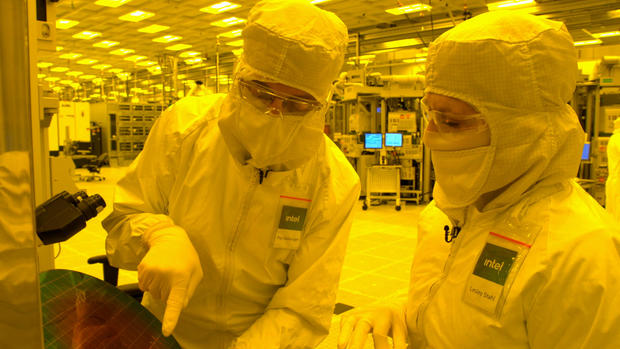

Intel is the most significant American chipmaker. Its most advanced fabrication plant, or fab for shorter, is situated outdoors Phoenix, Arizona. New CEO, Pat Gelsinger, invited us on a tour to see how amazingly advanced the manufacturing process is.

Initially, we experienced to suit up to stay clear of contaminating the fab: head-cover – on bunny suit – zipped goggles gloves… ready to go.

Lesley Stahl: I’m pristine!

Pat Gelsinger: Every little thing in this atmosphere is managed.

Collectively we stepped into a put with some of the most innovative new technological know-how on Earth.

Lesley Stahl: I want to request you why we are all yellow?

Yellow filters take away gentle-rays that are unsafe to the approach. Overhead a computerized freeway transports resources from a single machine to the up coming. The method entails thousands of steps, wherever layer on layer of microscopic circuitry is etched on to these silicon plates – that are then chopped up into chips that will close up in, say, your computer system. Building just a person can acquire six months.

Pat Gelsinger: You see, every single a single of these is a chip.

Lesley Stahl: Is a chip. I am astonished. I assumed chips ended up moment.

Pat Gelsinger: Effectively, just about every 1 of these chips has probably a billion transistors on it.

Lesley Stahl: Oh, my goodness!

Pat Gelsinger: So there is certainly billion minor circuits within of it that are all on one of these chips. And then one particular wafer could have 100 or 1,000 chips on it.

Intel’s purpose is to maintain shrinking the transistors’ dimensions, so you can pile much more of them on a chip to make it more strong and function more rapidly.

Pat Gelsinger: Each individual 1 of these is laying down circuits that are so a lot smaller sized than everything, your hair, you know, any other part of human existence. You know, a COVID particle is way even bigger than 1 of the traces that we’re generating right here.

Lesley Stahl: How substantially does this fab price tag?

Pat Gelsinger: $10 billion dollars.

Lesley Stahl: Billion??

Pat Gelsinger: $10 billion ’cause every just one of these parts of tools is it’s possible $5 million. That is a ton of hundreds of thousands of dollars.

Chips vary in dimensions and sophistication dependent on their end-use. Intel doesn’t presently make a lot of chips for the car-sector but due to the fact of the shortage it’s setting up to reconfigure some of its fabs to start off churning them out.

Lesley Stahl: I’m thinking, if we are going to carry on to have shortages, not just in automobiles, but in our phones and for our computer systems, for every little thing?

Pat Gelsinger: I believe we have a pair of several years right until we capture up to this surging demand across each individual part of the enterprise.

COVID confirmed that the global provide chain of chips is fragile and unable to respond promptly to changes in desire. A person cause: fabs are wildly highly-priced to develop, furbish, and maintain.

Lesley Stahl: it used to be that there have been 25 businesses in the globe that built the substantial-stop, reducing-edge chips. And now there are only 3. And in the United States? – You.

GELSINGER Retains UP FINGER

Lesley Stahl: One particular. 1.

Currently, 75% of semiconductor producing is in Asia.

Pat Gelsinger: 25 several years ago, the United States made 37% of the world’s semiconductor producing in the U.S. Today, that selection has declined to just 12%.

Lesley Stahl: Isn’t going to seem fantastic.

Pat Gelsinger: It doesn’t audio superior. And anybody who appears to be like at offer chain suggests, “That’s a issue.”

A trouble mainly because relying on one region, specifically a single as unpredictable as Asia, is remarkably dangerous. Intel has been lobbying the U.S. federal government to aid revive chip producing at home – with incentives, subsidies, and-or tax breaks, the way the governments of Taiwan, Singapore, and Israel have finished. The White Dwelling is responding, proposing $50 billion for the semiconductor field in the U.S. as portion of President Biden’s infrastructure program.

Lesley Stahl: Your enterprise is extremely valuable. In conditions of earnings, you made $78 billion past yr. Why should really the federal government occur in to a company, a enterprise that’s accomplishing so effectively general?

Pat Gelsinger: This is a significant, crucial business and we want additional of it on American soil: the work opportunities that we want in The usa, the manage of our long term technological know-how long run, and as we’ve also reported, the disruptions in the offer chain.

Lesley Stahl: You have used much far more in inventory buybacks than you have in exploration and development. A great deal much more.

Pat Gelsinger: We will not be anyplace near as focused on buybacks going ahead as we have in the past. And that is been reviewed as component of my coming into the company, agreed upon with the board of directors.

Lesley Stahl: Why shouldn’t non-public business fund this in its place of the governing administration? The industries that count on these chips – Apple, Microsoft, the companies that are rolling in money?

Pat Gelsinger: Effectively, they are quite satisfied to purchase from some of the Asian suppliers.

In fact, they you should not often have a alternative. For chips with the tiniest transistors – there is no “made in the U.S.” solution. Intel at the moment isn’t going to have the know-how to manufacture the most superior chips that Apple and the other folks will need.

Lesley Stahl: The drop in this field. It truly is kinda devastating, is just not it?

Pat Gelsinger: The fact that this market was created by American innovation–

Lesley Stahl: The complete Silicon Valley idea started out with Intel.

Pat Gelsinger: Yeah… The organization stumbled. You know, it’s still a major enterprise – we had some products stumbles, some producing and process stumbles.

Possibly the major stumble was in the early-2000s, when Steve Employment of Apple essential chips for a new plan: the Apple iphone. Intel was not interested. And Apple went to Asia, inevitably getting TSMC: the Taiwan Semiconductor Manufacturing Corporation – nowadays, the world’s most sophisticated chip-producer, creating chips that are 30% speedier and a lot more powerful than Intel’s.

Lesley Stahl: They are in advance of you on the producing facet.

Pat Gelsinger: Yeah.

Lesley Stahl: Considerably in advance of you.

Pat Gelsinger: We feel it is really gonna just take us a few of decades and we will be caught up.

Gelsinger is creating huge bets: breaking floor on two new giant fabs in Arizona, costing $20 billion Intel’s greatest investment at any time. And he introduced in May possibly a 3 and a 50 % billion greenback enhance of this fab in New Mexico.

But TSMC is a producing juggernaut really worth in excess of a 50 % a trillion dollars. Collaborating with purchasers to create their chip designs, it is really been sought out by Apple, Amazon, contractors for the U.S. military services, and even Intel, which makes use of TSMC to develop its chopping-edge patterns they’re not sophisticated sufficient to make them selves.

Lesley Stahl: How and why did Intel drop powering?

Mark Liu: It is astonishing for us far too.

We spoke remotely with TSMC chairman Mark Liu at the enterprise headquarters in Hsinchu, Taiwan. His enterprise is a primary supplier of the chips that go into American autos. In March, 2020, as COVID paralyzed the U.S. – motor vehicle revenue tumbled, major automakers to terminate their chip orders so TSMC stopped making them. That is why when motor vehicle income unexpectedly bounced again late final year there was a shortage of chips: leaving cars with no electricity parked in carmakers’ a lot – costing them billions.

Mark Liu: We read about this lack in December timeframe. And in January, we tried out to squeeze as more chip as possible to the auto company. You can find a time lag. In motor vehicle chips significantly, the source chain is prolonged and complicated. The source can take about 7 to 8 months.

Lesley Stahl: Really should Individuals be anxious that most chips are being manufactured in Asia right now?

Mark Liu: I understand their issue, initial of all. But this is not about Asia or not Asia I suggest, the lack will take place no subject exactly where the manufacturing is found simply because it is really owing to the COVID.

Lesley Stahl: But Pat Gelsinger at Intel talks about a need to rebalance the supply chain concern since so substantially, so lots of of the chips in the globe now are manufactured in Asia.

Mark Liu: I feel U.S. ought to go after to run quicker, to devote in R&D, to make additional Ph.D., learn, bachelor students to get into this production field in its place of seeking to move the source chain, which is very pricey and really non productive. That will sluggish down the innovation since– men and women hoping to keep on their technologies to their personal and forsake the international collaboration.

Inside the planet of world collaboration you will find rigorous level of competition. Days following Intel announced shelling out $20 billion on two new fabs, TSMC announced it would spend $100 billion in excess of 3 several years on R&D, upgrades, and a new fab in Phoenix, Arizona, Intel’s backyard, where by the Taiwanese organization will generate the chips Apple desires but the Americans can not make.

Mark Liu: That was a massive expense.

But there’s a looming shadow more than TSMC, which materials chips for our cars, iPhones, and the supercomputer running our nuclear stockpile: China’s President Xi Jinping, who has intensified his very long-time risk to seize Taiwan.

China’s tries to establish its individual highly developed chip field have failed and so it really is been forced to import chips. But previous calendar year, Washington imposed constraints on chipmakers from exporting certain semiconductors to china. Both equally Liu and Gelsinger worry the escalating trade war with China may possibly backfire, and in Intel’s situation: could hurt business enterprise.

Lesley Stahl: Are they your most important consumer?

Pat Gelsinger: China is 1 of our most significant marketplaces now. You know, over 25% of our revenue is to Chinese shoppers. We hope that this will continue to be an region of rigidity, and 1 that demands to be navigated meticulously. Because if you can find any details that men and women cannot preserve working their countries or jogging their businesses since of source of one particular significant component like semiconductors, boy, that qualified prospects them to choose pretty excessive postures on items since they have to.

The most extraordinary would be China invading Taiwan and in the approach getting command of TSMC. That could drive the U.S. to protect Taiwan as we did Kuwait from the Iraqis 30 years ago. Then it was oil. Now it is chips.

Lesley Stahl: The chip marketplace in Taiwan has been called the Silicon Protect.

Mark Liu: Yes.

Lesley Stahl: What does that mean?

Mark Liu: That means the planet all wants Taiwan’s substantial-tech market assistance. So they will not permit the war come about in this location because it goes versus fascination of just about every country in the earth.

Lesley Stahl: Do you feel that in any way your market is maintaining Taiwan risk-free?

Mark Liu: I are not able to remark on the safety. I imply, this is a altering planet. Nobody want these points to transpire. And I hope– I hope not way too– both.

Despite the international press to ramp up creation, the information is however grim. Some market leaders and analysts expect the scarcity to previous deep into 2022, or even 2023.

Produced by Shachar Bar-On. Associate producer, Natalie Jimenez Peel. Broadcast affiliate, Wren Woodson. Edited by Warren Lustig.